Welcome to my freemium newsletter by me, King Williams. A documentary filmmaker, journalist, podcast host, and author based in Atlanta, Georgia. This is a newsletter covering the hidden connections of Atlanta to everything else.

1. BET is potentially up for sale

Tyler Perry has officially put his name in the ring regarding a potential sale of BET. Perry has confirmed that the’s interested in buying a majority stake in BET should it become available. The announcement comes as Paramount Global, the owners of BET and VH1 is rumored to be willing to sell the company. The potential ownership of BET would be for Perry a culmination of his past thirty years in entertainment while setting forth a new pathway for the next 30 years of his career.

But Perry could be in for a bidding war as media mogul Byron Allen, Hip Hop legend Diddy, and a black-owned collective could also be in the running. All of this is predicated upon Paramount actually putting the company for sale.

2. Paramount Global

The 107-year-old Paramount Global (formerly known as Viacom, it went back to its government name during the pandemic) is looking at offloading BET, BET+ streaming service, BET Films, and VH1 in a package deal. For Paramount, the company has been mired in years of real-life succession issues. Now under the control of Shari Redstone, the daughter of deceased media mogul Sumner Redstone, Paramount is trying to find an exit when the business is changing rapidly.

Paramount finds itself in an odd-man-out situation. The company has the number one broadcast television network in CBS, the moderately successful Paramount Studios, book publisher Simon & Schuster, and a bevy of profitable cable channels including, MTV, Vh1, and Nickelodeon. Alongside the profitable premium cable network Showtime. Despite this, the changing media landscape, chord cutting, and the costs of pivoting to streaming are leading Shari Redstone to sell off all of these assets, preferably to one buyer. In a post-pandemic landscape, coinciding with a potentially pre-recession landscape, the company is less valuable now than it was 5 years ago.

3. The business is changing

Rupert Murdoch’s selling off of all of the Fox assets (minus Fox News, Fox Broadcasting, and Fox Business Channel, because of course not) to Disney in 2017 for $71 billion dollars was a sign that the business was changing. Prior to and since that point in time, Sherry Redstone has been attempting to sell off the company that took her father a lifetime to build. Rupert Murdoch, like Sherry Redstone, assessed that the media business would require a different level of capital and global appeal.

Unlike Fox, Paramount has a very different marketplace to contend with. With a greater potential that this company could decline even more over the next 12-24 months. Warner Bros Discovery is rumored to be potentially sold to Comcast’s NBCUniversal next year, building the first true rival to Disney.

Everyone is looking to sell, but are there buyers?

While other companies including Lionsgate, home of Tyler Perry’s older films, and the streaming network STARZ are also looking to be sold. While MGM went to Amazon last year for a surprisingly high $8.5 billion. Netflix entered a strategic partnership with SONY for its films. Netflix entered an ad exchange deal with Microsoft leading to a potential future exit for the company if necessary or it could address the long-held view of some analysis that it merges with Disney or Spotify.

Unfortunately, Redstone has been insistent on selling off the whole company as one piece. The company rejected a $3 billion dollar bid for Showtime. The company also rejected a bid from Netflix to purchase its film unit in a separate bid. Redstone is not foolish, the over-purchase of MGM by Amazon and the realization that consolidation will be in the next 3-4 years is trying to get the highest price possible. The problem is that there haven’t been many publicly interested buyers. The company’s stock price is below $15 dollars a share and its overall market cap is just under $15 billion. This is despite overall revenue of $30 billion.

4. Paramount and Paramount+

Paramount actually makes hits, CBS is the best-performing broadcast channel for nearly two decades now. BET, VH1, and Nickelodeon are consistently solid-performing cable brands. Its cable drama, Yellowstone is the highest-rated show on both broadcast and cable television. While its film studio has generated hit after hit including last year’s Top Gun: Maverick, a film that made $1.4 billion dollars. Paramount’s television and streaming ventures are anchored by Paramount+ the company’s global streaming service.

Paramount+

Paramount claims 56 million subscribers to its streaming service Paramount+ (which includes a bundle with Walmart+) and 21.4 million to Showtime. The company recently combined Paramount+ and Showtime into a single $11.99-month bundled service. Getting ahead of a potential bundle of Warner Bros and Discovery, which is set to announce this week. As well as 2024 which could see Disney merging Hulu, ESPN+, and Disney+ into one unified service—but that deal has a host of complications related to contracts and ownership stakes (Comcast in Hulu) to sort.

Paramount programming on cable

The company has been lambasted for its cable networks in recent years for its reliance on cost-cutting maneuvers. The chief criticisms have mainly been towards MTV airing repeats of low-cost programming.

Ridiculousness, an internet clip show aimed at younger millennials has been seen airing as much as 20 of 24 hours per day on that channel. But the show like so many in the Paramount portfolio gets consistent ratings, which retains paying customers and steady ad rates. By relying heavily on using primetime procedural shows, broad family sitcoms, awards shows (Grammys, Latin Grammys, Country Music Awards), and football, with college football-SEC/Big Ten and professional with the NFL’s AFC lineup.

Paramount programming on broadcast

While CBS’s broadcast programming has been less offensive and more adult-leaning but the company has still managed to produce an ecosystem of hit show after hit show. CBS primetime comedy and dramas are so successful, their secondary (first-run tv airings), tertiary (syndication windows), and quaternary (streaming) marketplaces are arguably just as valuable.

Paramount programming on streaming

Criminal Minds, a police procedural is one of the most streamed programs on Netflix. On the comedy side, CBS’s single-camera comedy Young Sheldon, a spinoff of CBS ratings juggernaut The Big Bang Theory is a top-rated first-run broadcast show. The show is such as success that it jumped its syndication window by entering the space in only its fourth season and being extended for three additional seasons. CBS brand is so strong that a show on the network can make money in every run of its viewing, something Netflix or HBO can claim.

5. BET

BET, the first major black-owned cable television network was founded in Washington DC in 1979, by Bob Johnson. For decades BET operated as the only Black-owned nationally available television channel in the US. The company sold for $2.3 billion in 2001 in the largest acquisition of any majority black-owned company in the US. Bob Johnson, founder of BET owned 63% of the company, while John Malone (white) owned 35% and 2% to a smaller group of founders.

BET has always been hindered by what it wasn’t

BET since its inception has never been enough for some people. BET under Bob Johnson was either too focused on music or not focused on music enough. The music also was chided for being too focused on mainstream acts, lack of uplifting music, or being a representative of the broader black music scene. BET could never be all things, but the BET of 2023 is much closer to the original intent than before. But now that audience and their grandkids, even great-grandkids are mostly entertained elsewhere. During the streaming era, there are more options, but BET still remains.

BET was chided for its lack of original and lack of grown-up programming. Or lack of news or the several attempts at delivering the news being passed over. People have always wanted BET to be something else, but the programming is more of a reflection of their own individual tastes than what audiences want to watch. The thoughts of ‘the new’ BET are bringing new articles on what programming it wants.

Some Millennials want BET to bring back the shows of their youth, which is understandable, and even a solid idea. But the BET of the acquisition is faced with two challenges, further, deliver programming the niche wants or spend big on a black demographic, mainly one online who states that they want a specific type of programming. Programming that is costly, time delayed, and often not watched enough to justify the efforts (See: Disney+’s efforts at revisiting old IP).

Projections on what people want from the ‘new’ BET

Throughout the 2010s BET has had several hit shows. It turned down the music programming (except for Gospel) in favor of dramas, comedies, stageplays, and made for tv movies. And while most Black viewers went elsewhere, the ones that stayed are the basis of the audience now.

Black women between 35-54. This shouldn’t be surprising, as black women are the most loyal television viewers. BET also realizes that a lot of its viewers are of faith, have families, and want escapist television, hence why Tyler Perry’s programming is so successful. BET is closer to being a Black Lifetime with Gospel and Madea than it is to being a Black CBS or Black HBO.

How BET fits in Paramount’s larger portfolio

Since its acquisition by Paramount in 2001, BET has been used as a portfolio brand. BET sits alongside the then-2000s-2010s strategy of having a large, niche cable network. Paramount would package its slate of networks to cable companies for carriage fees. The bulk offer worked well for nearly thirty years but now in a bifurcation of streaming first (Netflix) and cash flow first (box office) business models taking shape, the company is facing an uncertain future.

The company owns children’s centered brands Nickelodeon (Spongebob Squarepants) and pre-K centered Noggin (Paw Patrol). Alongside more conservative adjacent Country Music Television (CMT), young adult-centered Comedy Central, gay-centered Logo, and the retirement-age programming of CBS. Paramount across its broadcast and cable offerings holds some of the highest ad rates in the industry. Paramount works because it has the national and global scale of easily identifiable brands, brands that still generate ratings, which in turn brings in consistent ratings.

6. BET, BET+, and the state of streaming video

BET+

BET+ is a direct-to-consumer streaming video service. BET+ is not a part of Paramount+. It’s anchored by a large portion of Perry-centric content and surpassed 1 million subscribers less than a year after its launch. The company has not issued subscriber figures since. Rumors peg the company between 4-7 million subscribers. If true, the numbers would be the best-performing paid subscription service in the Paramount Global portfolio after Paramount+, the flagship service for the company.

BET and BET+ operate in a similar fashion to HBO/HBO Max. The linear television side has programming that is mostly exclusively airing first on cable combined with a simultaneous (ex: HBO’s Insecure, from Issa Rae) and/or time-delayed release on the streaming service. The streaming service has additional programming exclusive to the service (ex: HBO’s Rap Sh!t from Issa Rae).

BET launched two new Perry shows, The Oval, a DC-based soap opera similar to the Kerri Washington show Scandal and (vaguely Insecure-inspired) Sistahs in 2019, It was followed by two new BET+ exclusive* shows in 2020 Ruthless, a spinoff of The Oval, and Bruh, a male-centered comedic counterpart to Sistahs.

BET + is estimated to have 4-7m paying monthly subs and the largest paying black-centered streaming service in the US, if not the world. The 4-7 million subs is not a small amount but a pittance compared to the US subscriber totals of Netflix, Hulu, HBO Max, Amazon Prime, and even Paramount+.

BET Studios

BET created BET Studios led by Aisha Summers-Burke in 2021. The effort included equity partnerships with tv/film producer Kenya Barris, actress Rashida Jones, and veteran tv development executive Aaron Rahsaan Thomas. The goal of the company is to produce films catering to Black audiences for theatrical release. BET and its partners already produce films for BET+ and the BET cable network. BET could have a situation similar to Paramount/Paramount+ where two successful and complementary businesses work for each other.

Streaming video is still not profitable, it may never be

Streaming video is a costly endeavor. For most companies, streaming is facing the reality of being something consumers want, but are not willing to pay or pay the actual cost of the service.

Disney is losing billions despite record growth as the world’s number 2 streaming company. Netflix still owes about $20 billion plus interest for its endeavors. Paramount reports negative expenses related to streaming, it could be assumed the same for BET+. Streaming could eventually make dollars but today it doesn’t make any cents.

7. If BET is for sale, it’s gonna cost a lot

BET is the only black-centered media brand in the world that generates more than a billion dollars in revenue. BET generates between $1.2-1.5 billion dollars in revenue each year primarily through its combination of cable fees and advertising.

For Perry, this will likely take a private capital raise to have the necessary funds to acquire a majority stake in BET. Perry’s ownership stake in BET is not public. For Perry to acquire majority ownership in BET it would likely take somewhere between $1.5 - $5 billion dollars. Media companies tend to trade at 5-8x yearly revenues.

Despite Forbes declaring Tyler Perry a billionaire, based on his public deals, box office reports, stage play ticket sales, and other dealings, it’s unlikely he has the liquidity necessary to own a majority stake in BET without some sort of financial support. Perry could use a combination of collateral, debt, and minority partners to make this happen. Since this stake is for a majority stake, not a 100% acquisition, it could be less needed. If BET were to go for the same as proposed to Showtime’s $3 billion bid, a majority stake for Perry could be plausible to acquire.

8. Tyler Perry as the owner of BET

For Perry, BET represents the culmination of his artistic career. It also represents the next act for Perry as a major league media businessman. Tyler Perry’s long-term success could see him emulating Walt Disney. Yes, that Disney.

Tyler Perry could be the next Walt Disney, a media-centric mogul who has multiple, hyper-focused brands spread across a myriad of platforms. This strategy since its inception in the 1950s has been the envy of media companies trying to emulate ever since. Disney is a synonymous brand with family-friendly content. That content has extended into television, theme parks, merchandise, CPGs (consumer packaged goods), video games, books, and other forms of media. Perry, like Walt Disney, nearly 60 years ago could be closest to achieving a singular vision. Perry already has a fort.

From my 2020 newsletter: Tyler Perry needs a revamp

8D. Tyler Perry as 21st Century Walt Disney

Tyler Perry could be Walt Disney, a visionary figurehead of a media empire that grew through providing joy for his base but employed artisans to work and expand stories and experiences on behalf of the brand. But the Tyler Perry media brand needs to be associated with a more diversified product offering than what’s currently taking place. Tyler Perry is one man and that can only go so far OR reach a logical endpoint.

If Tyler Perry stopped filmmaking tomorrow what happens to his deals? His studio? His real estate holdings? It’s time for a revamp and maybe Tyler listens.

Tyler Perry’s future plans

Considering his ownership of an actual former US Army Base, Perry could start building out his own Disneyland-like experience on-site. Perry could be building out the next phase of his business, commercial real estate, and entertainment experiences. It seems that based on recent activity, Perry seems to be moving slowly in that direction. Perry is building a mixed-use entertainment district on his property soon.

Tyler Perry’s future depends on succession

Perry has already admitted to the need to cede some of the control of both the executive and the creative aspects of the company. Perry is over 50 years old and has a young son, who won’t be old enough to manage the company for maybe two decades. Perry has to be thinking of succession in two folds, immediate and long-term.

On the immediate, Perry could benefit from a company that is ready to continue if he ever decides to step down. Perry has already admitted to the need to cede some of the control of both the executive and the creative aspects of the company. For the long term, Perry could be aiming for someone who can scale the company to a level of profitability and awareness the likes of Disney and Universal.

Ownership of BET, an already established business with established leadership, a steady content pipeline, an already existing streaming service, solidified cable distribution, an easily identifiable brand, and a theatrical distribution partnership with Paramount make the most sense.

From my 2020 newsletter: Tyler Perry needs a revamp

…If TPS decides to ever go this route, amplifying new projects, building out intellectual properties (IP), fostering new fan bases, and creating new content within the TPS brand, we could have the first multi-billion-dollar Black media company. And there’s great evidence that this would work, just ask Disney. Disney has executed a strategy similar to this for the last decade, enhancing the sub-brands at home in the US and abroad. This strategy was so successful, Disney produced 80% of the top ten global box office hits in the US in 2019…

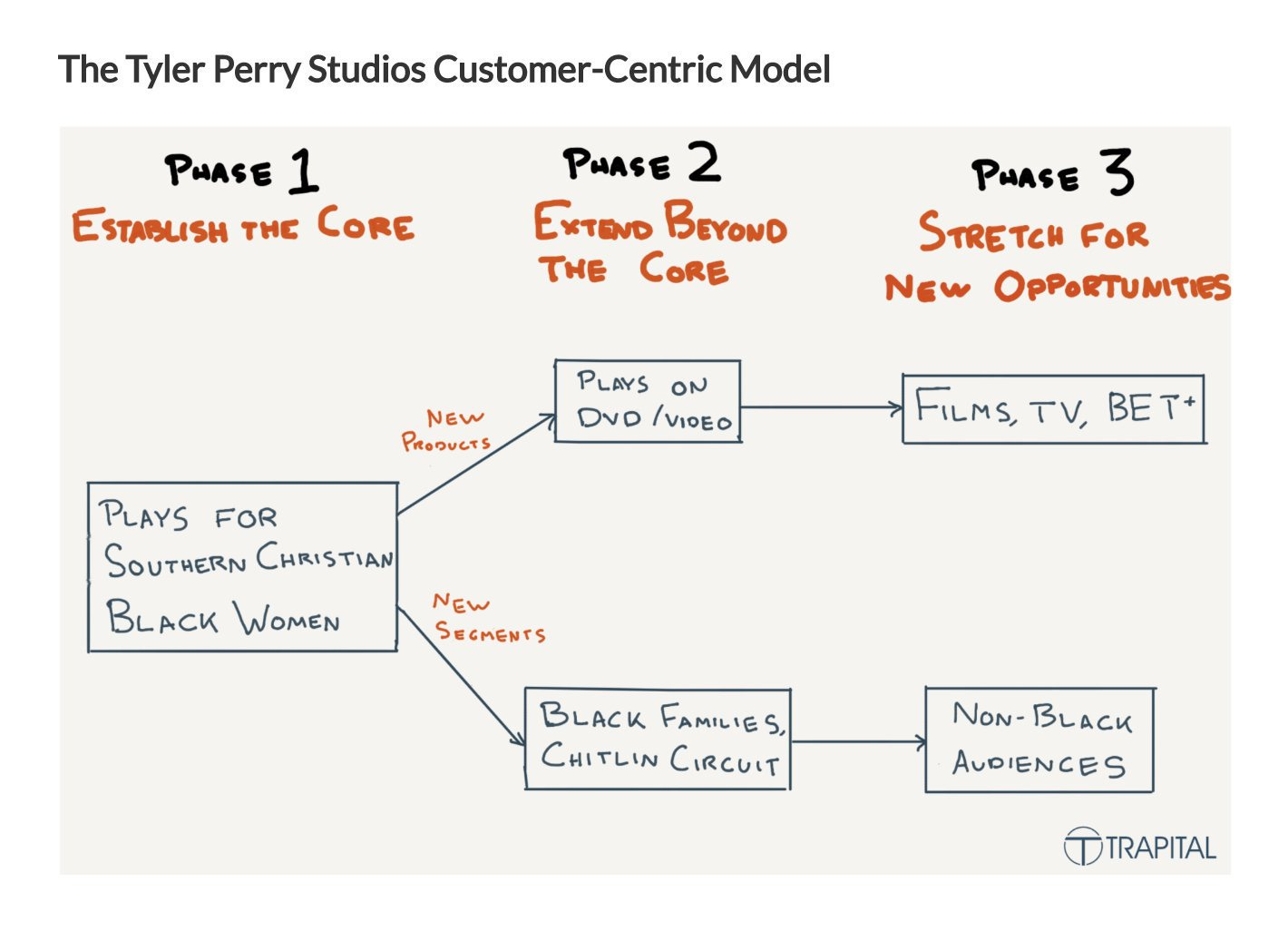

9. Perry’s dollars have always made sense for other companies

Perry has now revamped and brought financial success to three different networks, TBS, OWN, and BET in 15 years. For Perry his stable audience has allowed his work to be successful in ways that only a few media brands (ex: Disney, PBS, HBO) could do.

Perry’s runaway film, television, home video, and touring success were already drawing mainstream skepticism and surprise by 2008, a mere three years after his first film and two years after the trial run of his television show House of Payne on TBS.

From The Hollywood Reporter: Tyler Perry prepares to broaden his empire - 8/14/2008

Tyler Perry is on one heck of a run.

His five movies have grossed $250 million, and he’s sold 25 million DVDs. He’s got a top-rated TV show, another about to be announced and 11 boxoffice-busting stage plays. He’s landed a book on the best-seller lists and in October will cut the ribbon on his own studio complex…

…His TBS show, “Tyler Perry’s House of Payne,” goes into national syndication next month, and he’s readying a new series that, like “Payne,” might have managed another unprecedented 100-episode commitment from TBS.

House of Payne now airs on BET. With all-new episodes plus the episodes that were initially aired on PBS nearly 15 years ago. Perry’s true audience is on television, which has also aided in the success of streaming. A business model that sees greater success for mass-quantity television shows versus single-release movies.

Perry’s 10-90 model

Perry’s mid-late 2000s relationship with TBS led to an entirely new business model, the 10-90 model. In that model, Perry pays for the first 10 episodes of a series in production, the network airs the show, and should the show reach the KPIs, it goes into production for the next 90. The model has been attempted several times, but none of them have yielded the same level of success or the profitability outside of Perry.

From The Hollywood Reporter: Tyler Perry prepares to broaden his empire - 8/14/2008

…On the TV side, Perry’s “House of Payne” deal with distributor Debmar-Mercury also raised eyebrows. Ultimately worth in the $100 million range, the arrangement involved a standard 10-episode test run after which the writer-producer was guaranteed a not-even-close-to-standard 90 episode commitment in first-run syndication. And yes, he also owns the show outright.

TBS, which bought the cable rights, has no complaints. “Payne” debuted to record-breaking ratings in June 2007, becoming ad-supported cable’s most-watched original sitcom telecast ever among total viewers (5.8 million) and adults 18-49 (3.1 million). It also ranks as TV’s most-watched program among black adults 18-49 for the second summer in a row.

For the next 90 episodes, the network pays Perry with an immediate guarantee of broadcasting his shows + a first window into the syndication model. Those episodes are aired first on a specified date plus has the rights to the first airing of its syndicated episodes. Perry is also able to then license the rights to other partners for secondary and tertiary windows on broadcast and cable. The strategy anchored TBS as the home of broad comedies for a decade after.

Perry has been a consistent hitmaker

Perry got two networks, TBS and OWN into career-defining turnarounds before doing the same for BET. Perry now in this season, it makes sense to finally move into being a network, a distributor, a streamer, or all of the above, BET could be that play.

Perry also became the cash cow for the film studio Lionsgate in the mid-to-late 2000s. Perry’s first film Diary of a Mad Black Woman in 2005, was a surprise success. It led to a partnership that led to several more films in 2006 and 2007. It was extended in 2007, then again in 2009, 2010, and 2011, before the two parted ways in 2014 after a sharp decline in the box office as well as fan engagement. Perry pivoted heavier into television with a greater volume of soap operas, prime-time dramas, and family comedies, it’s still working.

Tyler Perry entered an agreement with Oprah to help anchor her then-fledgling OWN cable channel. That partnership was expanded in 2015. After the re-up with Perry, he also entered a deal with BET/Paramount which started in 2017 and ends in 2024.

Perry now entering agreements with Netflix and Amazon is reconstituting his network for the future. Perry already has ventured out of his usual pastiche with the release of A Jazzman’s Blues last fall. The film did moderately well on Netflix, remaining in the company’s top-10 movies for a few weeks, a feat most Black films fail to reach. Perry also inked a 4-movie deal at Amazon last fall.

Perry is branching out at the right time

Perry announced last year that he will be releasing his fourth Netflix exclusive film, Six Triple Eight, a World War II drama about the 6888th battalion, the only all-black, all-female troop during that time.

10. Byron Allen is the biggest challenger to Tyler Perry

Byron Allen is a former stand-up comedian turned entertainment industry mogul. Allen has spent the greater part of 50 years in the entertainment business building up a small, but highly profitable cable network portfolio. Allen has made his intentions of being a multimedia mogul clear. And BET could be the next chapter in his career.

Byron Allen has also stated publicly that he is interested in purchasing BET. For Allen, who has built his media empire through cable fees, BET would be a true signature property in his portfolio. Allen has proven time and time again that he’s been a master at acquiring the funding needed to build his media empire.

Allen made industry news when bought The Weather Channel for $300 million. Allen owns nearly three dozen television stations across the US already. Allen submitted an $8 billion dollar bid for the purchase of 64 TEGNA television stations across the US but was outbid by Bally Casino magnate Soo Kim. Allen also took Comcast to the Supreme Court in 2020 over racial bias allegations. Comcast won.

For Allen, BET would be a better platform to anchor his much smaller offerings.

Allen has also bought the Black-centered online media company The Grio, expanding that brand into cable and broadcast. Allen has entered a streaming partnership for HBCU football via his website HBCUGo. A likely move that will eventually be folded into the more established Grio brand. Allen also bought Black News Channel last year after it was shut down.

11. Here are the potential bidders for BET

Perry and Allen both could be in a potential bidding war for BET as music impresario Sean ‘Diddy’ Combs owner of the cable channel Revolt Tv has stated his interest. This is alongside Group Black, a Black-owned consortium anchored by Shea Moisture’s Richelieu Dennis and Travis Montaque, anchored with private equity backing who’ve also stated interest. Group Black also put in a bid for Vice Media at $400 million dollars. Vice Media has not publicly responded to the offer, the company is currently downsizing after losing so much of its media valuation over the last few years.

While Group Black, has access to major private equity firms, the sale is more dependent on what Paramount Global owner Sherry Redstone and the CEO are thinking. Redstone just wants money, while the current CEO of Paramount wants strategic partnerships going forward.

Tyler Perry and Byron Allen have advantages

It’s here where both Perry and Allen have an advantage. Allen has proven that he’s been able to make profitable, low-cost television for cable. While Perry has proven he can make hits in multiple media arenas—stage, home video, television, film, and now streaming. But for Perry, who has already established relationships at Paramount, a majority ownership stake of BET could be the most plausible outcome.

Perry already has several shows in production on on-air at BET. Perry also has a number of back title movies and stageplays in syndication on the network as well. While Allen has built out a sizeable array of advertisers for his broadcast and cable channels. Allen also has more experience in dealings with cable distributors.

There aren’t too many Black-owned cable television channels to acquire or scale

Since that time only a few companies have been successful at gaining adoption on cable. Diddy’s Revolt and in some limited markets Bounce TV have been added to cable and broadcast signals. Including CleoTv, and Black News Channel* (which was bought by Allen in 2022). Allen’s Entertainment Studios channels and Cathy Hughes’s, TVOne are the only nationally distributed Black-owned cable networks in the US. OWN, Oprah’s channel, was bought out by Discovery.

Paramount could sell all of the company or BET to the highest bidder

Paramount has attempted to sell some of its assets to mixed results. The company recently turned down a $3 billion dollar offer to purchase Showtime. While its book publisher Simon & Schuster, recently saw its plans to be sold to Penguin-Random House for $2.2 billion be rejected over regulatory concerns by the DOJ.

BET could go for more than what it’s worth since it’s a part of a declining asset in cable television, albeit one that still provides tremendous cash flow. But Shari Redstone seems intent on selling the whole package to the highest bidder. If she can’t then expect BET, Showtime, Nickelodeon, and Paramount Pictures to all be for sale.

What happens if Perry doesn’t get the bid?

There is a scenario in which Perry either is not allowed to bid on BET (if Shari Redstone sells the whole company), loses the bid for BET (to someone else, likely Byron Allen), or simply passes if the offer is too steep. Perry could also not have Paramount/BET extend his deal which ends in 2024 currently.

Perry would likely have to find a new distributor for his theatrical films, increasing the need for immediate revenue for the company. Perry would also need to find a streaming home for his library and any new films/plays/television shows. Perry would also need to find new partners for syndication for both cable and broadcast television, with the hopes these would be partners for new projects as well.

12. Who’s the best option for BET?

Diddy and Revolt aren’t operating at the level of TPS or current BET. Tyler Perry has talent relationships + the additional value of having a positive relationship with Perry. Byron Allen is on tv business but is not generating the hits or awareness needed to maintain BET. Allen has been rumored to be a frugal owner and that could be even more so than Perry, who’s often chided for his budgets on some of his films.

BET under either would have to deal with a cashflow positive BET that will still need to enter new business models to maintain cashflow. BET under either would need a different set of parameters to maintain success.

Perry seems to be making the most moves for a longer play at mainstream success. The company is already gearing up with some new executive hires including promoting Mark Swinton to SVP of Scripted Programming. TPS has also entered a production agreement with producer Deniese Davis’s company. Davis was the co-executive of Issa Rae’s Insecure on HBO and Rap Sh!t on HBO Max.

While Traci Blackwell stepped down as EVP, of Scripted Programming for BET Networks after only 18 months. Blackwell, a tv veteran was the former SVP of Programming at the CW. The company also lost its production executive, Michelle Sneed in 2018 to Perry. Sneed has since left the company this year to start her own production company.

Perry also entered a partnership with Tim Palen in 2019 for a new production company, Peachtree & Vine Productions. The company announced last spring its first potential project, a Lawrence Fishburne starring drama that has not been updated since. But the company entered pre-production on a thriller with the über-successful Blumhouse Studios entitled Help and several other concepts characterized as in development.

13. How does BET in the new media era look?

BET could exist as a similarly successful version of the anime-centric Crunchyroll. Crunchyroll’s successful business model + an added bonus of the Tyler Perry media flywheel or a Byron Allen ad base could be the leader undisputed leader in black-owned media.

Crunchyroll has managed to use a similar streaming strategy alongside a theatrical release model, merchandise, and events to help bring in additional cash flow while also appealing to the base.

Or BET could just maintain its current model

BET has a successful strategy already— buy/license smaller films and play on the network. Streaming may never be profitable. BET’s current strategy of reality, documentaries, licensed films/tv shows, stand-up comedy + a specialty of religious programs could be a solid offering going forward. It may not grow subs or expand its base, but it would aid in reducing churn in an era of cord-cutting.

BET could buy other streaming services.

BET with its current cash reserves could buy other smaller services. Or at least license content from them. Or maybe work with the creatives who already have shows on these rival services. There are possibilities. The new BET should consider them all.

There are several Black-owned streaming services already: Kweli Tv, Black N Sexy Tv, Tonight’s Conversation, KevOnStage, 85 South’s Channel 85, All Blk, Brown Sugar, Black Box Movies, AfroKids.tv, Urban Movie Channel, Art House International, Urban Fix, Afroland, and American Legacy Network, to name a few. Not to mention all of the Nollywood films that exist. Amazon’s film program could be another option as third-party filmmakers can upload their films to the company’s portal and use that as a way to gain viewers through Prime Video or its free tier Freevee.

The best partners for the new BET

For a potential new BET, the best bets seem to be working with KevOnStage, 85 South, All Blk, and Urban Movie Channel. Kweli Tv’s ability to find hidden gym documentaries across the African Diaspora works well for BET. KevOnStage’s churchy content + his relationships with a growing pool of actors and comedic talent could easily expand the BET brand in (Christian) faith-based programming. All Blk and Urban Movie Channel’s programming better fits the need for BET’s movie of the week and aids in increasing its streaming volume.

Perry could start looking heavier into YouTube for additional creators, it worked out well for HBO and Issa Rae. While a newer Gen Z level of creators, personalities, and actors/actresses on TikTok could also be a way to generate new interests. Tyler Perry’s done it before with YouTubers Liza Koshy and Fousey in the Madea Halloween films. BET does it currently with its movies of the week. It may be time to revisit that strategy.

How BET+ could work

When it comes to streaming, dramas draw in prospective subscribers, comedy retains subscribers, with documentaries serving as filler between both. Within that lower-cost programming options such as stand-up comedy, reality shows, and talk shows are anchors in maintaining paying subscribers. Add in a constant rotation of licensed current programs and classics, this is a smaller, specified version of Netflix.

BET would have to operate as the biggest player within a specified niche. Offering better curatorial direction + a smaller, but defined mix of originals. Or it could enter licensing deals and strategic producing partnerships to steady the brand in the streaming era. Streaming relies on network effects, including actual in-network promotion, 3rd party branded ads, and streaming lead-ins from other shows.

The next BET would need fewer projects and more talent that could work for cheap. Licensing already finished products works really well, ask Tubi. The free streaming service that’s been seeing nonstop growth since 2020. Tubi has been able to grow in part because it offers an alternative to paid streaming services + follows the established standards of content (arguably of lower quality) set forth by established players like Netflix. Tubi’s niche success is helping it win in the streaming wars.

Regardless of what happens next, BET is in for a change, and who that is will matter a lot. If it’s Tyler Perry, Atlanta can expect its first real national media brand since Ted Turner’s own channels CNN, TBS, TNT and Turner to be anchored in the 404.

Again, I’m so sorry for the unfinished draft going out earlier and I hope this was okay.

-KJW