The Hawks need Trae Young to be LeBron James to sell a 5 billion dollar real estate development

Trae Young secured a BAG but the owners took a lot more

Welcome to my freemium newsletter by me, King Williams. A documentary filmmaker, journalist, podcast host, and author based in Atlanta, Georgia. This is a newsletter covering the hidden connections of Atlanta to everything else.

Written by King Williams

Edited by Alicia Bruce

The Hawks need Trae Young like teams need LeBron and Steph

Atlanta Hawks star Trae Young has signed a massive five-year, $207 million dollar deal. The deal begins in the 2022-23 NBA season as Young, the star of the franchise will now be tasked with guiding the Atlanta Hawks to their first NBA championship.

While the deal may be surprising to non-NBA fans, it’s part of a longer play for NBA teams to retain star players. Players who may not win on the court but off the court as well. A star player in the NBA can be used as the linchpin for ownership groups who are looking for gateways into new revenue opportunities.

Trae Young may have received a $200 million contract, but the ownership group got a nearly $2 billion dollar subsidy from the city. This is on top of an additional $193 million in city funds which were used to renovate an arena that opened 18 years prior. The Hawks owners have their money upfront and now will rely on a 22-year-old to be the centerpiece of the biggest real estate deal in Georgia history.

1. Why did a 22-year-old get $207 million dollars?

Trae Young’s contract extension is what’s known as a supermax (maximum salary), which is the most amount a player can receive if they don’t leave their team.

Unlike other jobs, NBA players upon first entering the league do not have a say-so as to where they will work. Players like Young, who was selected fifth overall in 2018, these elite players are legally bound to four-year contracts with their respective teams. During this period the team can decide much of the player’s future.

This includes if the player gets traded, if they receive any playing time if they are dropped from the team, what position they can play, and/or be demoted to the developmental league if they are not performing up to expectations. This is often accompanied by a fixed salary that keeps young players such as Young in underpriced contracts favorable to the ownership.

Other leagues have similar structures but are not as restrictive as the NBA is with its young players. These players then move into a period of semi-autonomy in what’s known as free agency. Free agency is divided into two types: restricted (needs permission from current team to be moved to another team) and unrestricted (can find a team on their own).

And for more information, just check out this video on how NBA contracts work from The Ringer:

1B. NBA salary cap explained

Every team gets the same designated amount of money per team to spend on player salaries. The salaries are based on total league revenue from the previous year.

The revenue derived in large part from television contracts + licensing + merchandise; et al. Every team must meet a salary minimum. Teams often pay the top-2 players 40-60% of the salary threshold, with players 3-5 talking up the other 15-30% of salaries. So out of a 12-15 person NBA team, nearly 2-5 players can take up almost 90% of the designated salary. It can get more complicated than that, so we’ll leave it there.

If a player the likes of Young remains in the league after four years (the average NBA career is three years), plus reaches league-defined success metrics such as MVP, Rookie of the Year, an All-Star game selection, an all-NBA designation, or other league-wide accolades, they can be paid a lot more. Often these players are on current or formerly struggling teams, and teams couldn’t normally afford or entice players to join them.

The Hawks are paying Trae Young nearly half of the budgeted team salary because they believe his on-the-court performance + (most importantly) emerging brand are worth it for the franchise’s long-term value.

1C. LeBron James is why the supermax exists (important for later)

The super max contract was created to offer superstar players substantially more money than they would’ve normally been paid in the NBA open market. The rule was instituted for smaller market teams who have top-tier players such as LeBron James, who have left small market teams for bigger ones.

Thanks to James, a native of Akron, Ohio was drafted with the first pick in the 2003 NBA draft by the Cleveland Cavaliers. A phenom from his middle school years, James was tapped to be the heir apparent to the greatest basketball player of all time, Michael Jordan.

1D. The Player Empowerment Era of the NBA

Upon his arrival in Cleveland, James was an immediate star in the league. This was a bonus for a struggling franchise in a media market that was less than desirable. So when James decided after the first seven years of his career, to leave the Cleveland Cavaliers for the Miami Heat, the team’s value collapsed. Other players also began to do so in the subsequent years in what is known as ‘the player empowerment era’ existing from 2010-present.

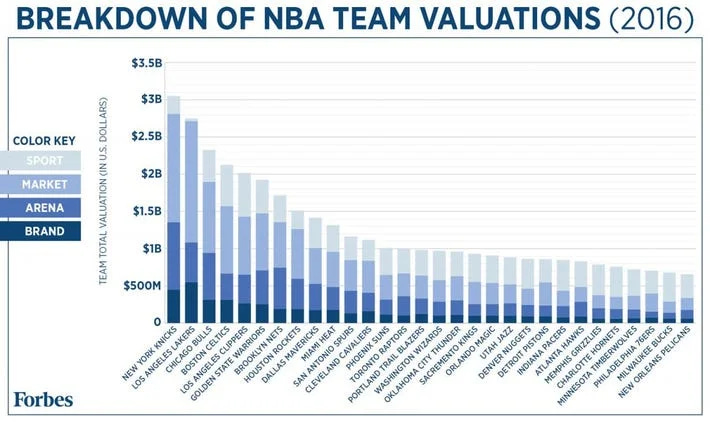

When a player leaves for a bigger, more well-known city, often there is a corollary effect on the loss of the team’s valuation. While James was vilified for it, the move was correct for his brand and bottom line. Thus the supermax was pressed to the league commissioner by owners as a solution for losing star players. Often players in less than desirable cities as a hedge in retaining their franchise’s value.

2. How do NBA teams make money?

Like many pro sports teams in the US, often times these are much less about the performance of the teams as it is the real estate that they own.

2B. It’s not owning just the team, but the arena and its businesses

Owning an NBA team means owning a very large portfolio of smaller but niche businesses. Owning an NBA team means you also own: an ad business, a parking business, a commercial + office leasing business, residential development + property management, event space, a concert venue, plus a restaurant and retail business.

This is in addition to being a television content distributor, as NBA games provide 82 regular-season games to broadcast, cable, and streaming services. It’s on television where the majority of all sports teams make their cash money. But it’s the real estate where the valuations soar. The NBA unlike other leagues has nearly all of its teams situated directly in urban cores, cores which have reaped the benefit of back-to-the-city economic growth of the last 25 years. This has given these teams a unique advantage in their valuations over their counterparts in the NFL and MLB.

3. There is a blueprint for how to redevelop (or gentrify) using sports teams

The Hawks and CIM need Trae Young to be an all-NBA caliber of player to sell this property, which is a lot of pressure for a 22-year-old. But the blueprint on how to use one successful player + a supporting cast of characters has existed for a while. Now Atlanta is about to see if this strategy works—but they are following a blueprint for a successful downtown. A strategy that started in Baltimore 29 years ago.

3B. Camden Yards

Camden Yards in Baltimore is the archetype for revitalization (or gentrification) of a city using a new sports stadium.

When the Baltimore Orioles baseball team decided to move to downtown Baltimore in 1992, the stadium and its throwback aesthetics became the standard of how baseball stadiums were built for the next twenty years. Its location in a de-industrializing part of the city also led to a multiplier of revitalization and eventual gentrification throughout Baltimore.

Camden Yards showed how stadiums could be monetized for maximum revenue in urban areas, reshaping how all American sports franchises would operate going forward.

3C. Michael Jordan and the United Center

Michael Jordan may be the most popular American athlete ever. His image and likeness alone took a struggling Chicago franchise into the league’s premier team for nearly a decade.

The daily broadcast of Michael Jordan and the Chicago Bulls on local + national broadcast stations across the US and cable television (ESPN) gave the city of Chicago an unexpected tourism boost. So when the team demanded a new arena next to the old Chicago Stadium the city made room to push through dozens of city blocks for street-level parking lots to accommodate the new arena.

3D. Kobe + Shaq and the rise of LA Live

The immediate post-Michael Jordan era gave rise to the new Shaq and Kobe Los Angeles Lakers. The combination of the Staples Center + the development of LA Live aided in the remaking of downtown Los Angeles.

That one-two punch provided the impetus for gentrifying downtown, Los Angeles. The Staples Center + LA Live combination has been so successful that now the Atlanta Hawks are hoping to replicate that model here in Atlanta.

4. Paying Trae Young is a calculated risk for a real estate development project aimed at ‘New’ Atlanta

Both the Hawks and Centennial Yards are owned by various members of the Ressler family—brothers, Tony and Richard. Tony owns the Hawks, while Richard is the founder at CIM, the real estate group leading the construction of Centennial Yards, the new multi-billion dollar mixed retail project located directly across the street.

After Tony’s investment group purchased the Hawks in 2015 to the tune of $850 million, Richard’s CIM Group turned around two years later and moved on to purchasing The Gulch, a 50-acre stretch of former rail yards located directly across from State Farm Arena for $115 million in December of 2018.

4B. The Gulch

The Gulch is a nearly 200-year-old rail depot directly across from State Farm Arena. The Gulch has served as a parking facility for the Atlanta Hawks since the 1970s.

However, the CIM group has strong-armed the city into developing the area, and instead of attempting to develop on the actual street level, most of the money accrued by CIM will go towards the construction of the facility including an 8,000 unit parking facility to bring the structure to the ‘street level’ of State Farm Arena, despite being directly next to a MARTA train station.

4C. White Flight

It wasn’t until the white flight movement out of Atlanta beginning in the 1940s-70s and a very bad stretch of 1950s-1980s ‘urban renewal’ projects that downtown Atlanta became a sea of parking lots. These urban renewal projects and newly created parking lots were created in hopes of bringing back white suburban fans into the majority-Black downtown Atlanta.

Atlanta’s white flight decimated the city with the construction of the highways proceeded by the departure of the white-owned business ecosystems + residential neighborhoods. As a result, the sports in Atlanta have never reached their fullest potential as white fans don’t live/work/play near the stadium. Something the Braves realized and left for Cobb County in 2017.

4D. ‘New’ Atlanta

This site of Centennial Yards is an Atlantic Station for the ‘West Midtown’ crowd. This ‘new’ Atlanta has been the fruition of nearly 25 years of gentrification and revitalization efforts finally coming to fruition. This ‘New’ Atlanta is a long sought-after demographic of people who are younger, wealthier, often not from the state of Georgia, and more often not Black. ‘New’ Atlanta is economically appealing to this generation of developers in Atlanta who’ve moved towards suburbanization. This ‘new’ Atlanta is also now comprised of people who don’t have any historical connection to the city of Atlanta, nor are they familiar with downtown.

5. Centennial Yards is too big to fail

To many in the city, The Gulch is a linchpin of the misplaced priorities of Atlanta’s emphasis on development at all costs. The project was purchased by the Ressler’s three years after purchasing the Hawks in 2015.

5B. The Gulch was fast-tracked for the potential of Amazon’s second headquarters

The effort to fast-track the Gulch including its massive city-funded subsidy was one of the rare occurrences that a big development project in Atlanta was split amongst city leadership. The contentious project was part of a failed pitch to lure Amazon for the headquarters of their East Coast office. Part of that failed fast track was a push to secure nearly $2 billion in public funds going toward the completion of the project.

That backlash between the city council and the newly elected mayor Keshia Lance Bottoms who was sworn in a few weeks prior was the first real mark against her tenure. The subsidy was passed by one city council vote in 2018.

Even then, it was only after some serious wrangling of the funds related to the Eastside Tax Allocation District (TAD) that was meant to support the Atlanta Public School system, the project came to fruition. The dedicated $1.9 billion in funds could’ve been used for a myriad of other things, especially not the construction of another parking lot. This was on top of a then-recent $142 million dollar deal brokered between the city and the Hawks to renovate State Farm Arena.

6. The Hawks are hoping Trae Young can be the next Stephen Curry

The presence of Steph Curry, who was drafted in 2008, has raised the value of the franchise by over 1,000% since then. As a result of Curry’s success on the court, the team has gone from a $335 million valuation in 2008, (then the-18th most valuable team in the NBA) to the second most valuable team in the league at a $4.7 billion dollar evaluation. This growth has allowed the Warriors to become the 6th most valuable sports team in the world. This includes a new $1.4 billion dollar arena across the Bay in the heart of downtown San Francisco.

Since being drafted by the Hawks three years ago, Young has been compared to Curry. And while both are known for being undersized point guards, who can shoot three-pointers from the parking lot, Young is tasked at a much earlier phase of his career with being a face of a franchise. A franchise whose success on the court is a big factor in several real estate developments off the court.

7. The Hawks are hoping for a ‘LeBron effect’ for Trae Young

While LeBron has done an arguably more important economic boost for the Cleveland Cavaliers and the local economy. The Cavaliers, like the Warriors in Oakland, was a downtrodden city with a basketball team in the midst of a prolonged losing record.

Cleveland was often one of the lowest-performing teams in the league. LeBron‘s effect was so big in both iterations of his time in Cleveland, that his mere presence on the team has anchored tens of millions of dollars in spending around downtown Cleveland. LeBron himself from 2003-10 was the economic anchor in the revitalization of downtown Cleveland.

From ESPN: LeBron James is worth hundreds of millions to the Cavs and Cleveland (6/13/18):

(Daniel) Shoag found that LeBron's presence, and the effect he had on attendance, increased the business of eating and drinking establishments by 13 percent and employment by 24 percent in Cleveland.

LeBron’s first seven years spurred new restaurants, new retail, alongside a commercial and residential real estate boom. LeBron’s effect was so pronounced that by the time he left the first time in 2010 for South Beach, the franchise lost one-fourth of its value.

His 2014 return to the Cavaliers kicked off a new wave of consumer spending in the city, recapturing the millions in lost city revenue in addition to returning hundreds of millions in value to the franchise. James additionally had an economic impact on the Miami Heat, but nowhere near to the degree of his impact on Cleveland. This also has translated in Los Angeles where he is estimated to bring in an additional $400 million to the economy as well as 3,000 additional jobs.

8. NBA athletes become walking travel advertisements for their teams and cities—the Hawks need Trae Young

Everywhere LeBron plays, he is an actual economic gravitational force unlike anything seen in the NBA. James, like Curry, has an ancillary effect as the league’s top player.

In the case of James, who has taken over the mantle of head Laker in 2019 after the retirement of the late Kobe Bryant in 2016. For the Buss family (the owners of the Lakers), having LeBron on the Lakers for only $38 million per season is actually a steal. Due to the league’s salary cap rules, having LeBron on the Lakers is a fixed cost for the team and he can’t make anywhere near his true market value.

Centennial Yards as LA Live 2.0

Traveling fans to Los Angeles see the Lakers but they also pay even more money to eat, shop or stay in LA Live, the entertainment district directly outside of The Staples Center where the team plays. The Hawks and the California-based CIM group are taking that same downtown sports-as-economic revitalization playbook in the development of Centennial Yards.

The Hawks and CIM are hoping to have the same success as the Lakers in downtown LA. The long-term bet is for Trae Young and the Hawks to continue winning, becoming a national phenomenon that people would theoretically stay overnight at a hotel, and spend money at the dining options at Centennial Yards.

The value proposition of an east coast LA Live is dependent on a winning franchise and playing every year in the NBA Finals. An NBA Finals broadcast to millions worldwide from the US to China is a win-win for the franchise, Centennial Yards, and downtown Atlanta if* this works.

This was a lot, I hope you enjoyed it or at least learned something!