The Week in Review: RIP Cicely Tyson, GameStop and Clubhouse are where the money resides

Hey, I’m running a special, get 50% off a subscription at $5/month or a yearly subscription at $50/year. Offer expires 2/28/2021.

1. Rest In Power Cicely Tyson

Thursday saw the passing of icon Cicely Tyson at the age of 96.

Tyson was an actress whose films span decades. She purposely took roles that portrayed Black people in a positive light, defied stereotypes, or reflected the history of Black people. This included roles in films such The Autobiography of Miss Jane Pittman, about the life of a woman who was born in the last years of American enslavement all the way until the beginnings of the civil rights movement. Tyson was also married to all-time G.O.A.T., trumpeter Miles Davis.

Tyson was known for both her artistry and activism throughout her career. Her increased presence in the 1970s brought mainstream legitimacy to issues affecting Black women which included issues of gender, race, hair, and respectability. Tyson also helped to destigmatize the presentation of Black women’s appearance by purposely choosing to highlight her natural hair, natural facial features. This was in addition to Tyson openly endorsing pro-Black positivity when the film industry was focused on highlighting poverty, crime, and Blaxploitation in the 1960s and 1970s. Tyson was one of the few actresses of prominence in the 1970s to still have a career in the 1980s and 1990s often being seen in a variety of Black-led films.

Tyson gained notoriety for a new generation by her constant appearances in films by Tyler Perry. Perry’s films opened up a new audience to a woman whose life has spanned several important milestones in African American history, making them more applicable to these new generations. Tyson’s death comes on the heels of her recently released memoir and a press tour that has inadvertently captured her final days. Tyson died in her home in her sleep at age 96, but not before ensuring that she made her mark on society.

2. GameStop is where the money resides

Only one week into the Biden administration and no one could’ve seen this coming, well almost no one.

On Wednesday a subreddit known as r/wallstreetbets staged a national kerfuffle on the stock market, unlike anything that’s been seen before. What was initially started as a topic by Reddit user Keith Gill aka DeepF—ingValue, quickly evolved into a rallying cry against late-stage vampire capitalism.

This attack focused on hedge funds, specifically Melvin Capital, which had placed a bet on video game retail company GameSpot going under in what is known as a short. Several members on the r/wallstreetbets thread were also gamers and realized the bet that was taking place. This resulted in a counter bet on Melvin Capital in what is known as a short squeeze. A short squeeze often requires a loan or cash infusion to make it happen, due to the risky nature of this type of bet on the failure of a company. This is because if the company that initiated the short squeeze were to ever lose that bet, they would be responsible for the losses—which may have just happened to Melvin Capital.

IF this is still confusing, this entire scenario swapping the Reddit connection is the plot of the wonderful 1983 Eddie Murphy-Dan Akroyd comedy Trading Places. The movie and its exposing of stock manipulation are so influential it has inspired a real financial rule known as the Eddie Murphy rule, seriously.

This type of short selling has been a hallmark of the financial industry for years, especially hedge funds who are often associated with purposeful attacks on vulnerable companies in the market (see Toy’s R Us). These short sells offer both immediate profits to financial institutions as well as provides an opportunity to: a) acquire a company, b) its assets, c) intellectual property, and/or d) key patents, as the company is likely about to go under. These moves often take tremendous amounts of capital to do so, as well as an understanding of the marketplace.

The most basic explanation of the stock market

Stocks are individual pieces of ownership of a company.

Stocks are typically issued because:

a) A company can no longer raise money in the private market

b) A company has no more space for meaningful dilution (ownership stakes)

c) Needs to raise an amount of money so big that it would be better to have more public buy-in

d) Can’t get any additional funding, with the only remaining viable option is becoming a publically traded company.

Shares, exchanges, indexes, and investors

Shares

These shares (stocks) are issued in what is known as an initial public offering (IPO) which is the first public debut of the company for anyone to own a piece of. After a company is listed on the stock market the company typically issues a progress report every three months in what is known as a (quarterly) earnings call. These earnings calls are updates on the health of the company, a look into future endeavors/expenditures, and allowing for questions. These are typically issued in a text-based format accompanied by a phone call to top shareholders with the company CEO, President, key management, and whoever else is deemed important at the time.

Exchanges

The oldest stock exchange in the world is the London Stock exchange and in the US it’s the New York Stock Exchange (NYSE). The younger, more tech-based stock exchange, NASDAQ started in 1971, while the Dow Jones is a constantly updating list of the 30 most important companies in America. This system of earnings and listings are evaluated by Wall Street analysts who issue what is known as guidance, this guidance is used by shareholders on whether or not to buy more stock, sell off stock, or maintain their holdings of stocks.

Indexes

The Standard and Poors (S&P, S&P500) is an index of the 500 largest publically traded US companies by market capitalization (cap). This listing spans 11 different markets in the US, with the goal of reflecting the overall performance of the economy from the biggest players in the industry.

Investors

This results in there being two types of investors: institutional investors, which includes established organizations like hedge funds, index funds, and retail investors, which is for everyday people.

The stock market is not necessarily a reflection of the economy. Nor is it a reflection of the national debt, unemployment/gainful employment, or the gross domestic product (GDP). The stock market is a reflection of the health of publically traded companies and the financial values of these companies to the investors (shareholders) of these companies.

Explain to me what Robinhood had to do with this?

Robinhood, the financial trading app is facing pressure from its users and company investors as a result of Wednesday’s debacle. The company was forced to stop trading on the stocks on Wednesday due to the surge in activity in the marketplace. This stopping of trades by Robinhood caused many users to cash out from the app, while some were paused from trading, and others moved to rival payment processing companies. Robinhood now finds itself in a potential class-action lawsuit from both its current and former users, its investors, and likely punitive action by the federal Securities and Exchanges Commission (SEC).

3. Atlanta based and Black-owned startup, Calendy has raised $350m at a $3 billion dollar evaluation

Atlanta based company Calendly has raised $350 million at a $3 billion dollar evaluation.

This company’s success story is a testament to a new Atlanta tech-based startup ecosystem that’s been less covered compared to rising tech hubs Austin and Miami. This evaluation also comes at a time in which calls for equity and funding for BIPOC and women-led startups comes under more scrutiny. The company was founded by Tope Atowona in 2013 at the Buckhead-based Atlanta Tech Village (ATV). The company was intially funded by ATV founder David Cummings and is a representative of the growing tech economy here in Atlanta.

4. Clubhouse Black-hacked its way to a $1billion valuation

Clubhouse, the audio app has been in the news this week after receiving a surprising $1 billion dollar evaluation after successfully completing its Series B funding round.

Check out the 50:00-1:02:00 mark only of the Joe Budden Podcast to understand the ire.

Clubhouse started out as an audio chat room for Silicon Valley and tech-based professionals to speak to each other. While this app stalled out in user growth by the summer of last year, it would take a pivot towards a new demographic who have shown success in producing virality and consumer buy-in, Black people.

Clubhouse’s actual success didn’t come from Elon Musk, Andrew Chen, or any other tech-based developers who have echo chambers of worship, but through Black-hacking. Black-hacking is an interpolation of the concept of growth hacking, a term often used by current-day tech-based companies and personalities. In growth hacking the key tenet is finding a way to scale a company, service, user base, or product into notoriety. That notoriety is then used to parlay the company into some sort of conceptually viable business model which can lead to either more funding, increased public awareness, an acquisition, or IPO.

It’s a manufactured hype cycle used to create demand for a product, business, or service that may or may not exist. It is not too dissimilar to that of what Wall Street does to either buy, sell, or short stocks. But in this case, over the last decades, social media companies benefit from Black creators using, advocating, peer-to-peer referrals, and owning the public conversation. This has been the case in almost every social media company, music services, and ideas. This scalability of Black people in pop-culture and businesses is not anything new. While Silicon Valley is espousing praise to Clubhouse, its founders, its investors, and a slew of tech concepts, it was the oldest strategy that actually worked that’s being lost in the sauce—Black people are the culture.

Clubhouse has scaled from about 1,500 users in May of 2020 to 600,000 users in December of 2020, to 2 million+ in January. The app is invite-only, only available on iOS devices, and has a waitlist. The company notably received a whopping $100 million dollar evaluation in May of 2020, despite having fewer members than my own Instagram account, on top of no discernible business model or growth pattern. The company closed a $100 million dollar, Series B investment round from famed tech-based venture capital firm Andreesen-Horowitz valuing the company at $1 billion dollars. This evaluation combined with its pre-development $15 million dollar investment before a prototype was even created has drawn well-deserved ire from many who have been locked out of the white male investment circles of Silicon Valley/tech-based venture capital firms.

5. Marjorie Taylor Greene

Freshman Georgia Congresswoman Majorie Taylor Green has caused quite the uproar.

MTG has already been on the watchlist since the early stage 2020 election cycle by liberals, journalists, now members of her own party, and now law enforcement.

Greene was one of several people temporarily suspended from Twitter in the wake of the January 6th attempted coup on the US Capitol. Greene came back in the news after members of her staff got into a verbal argument with members of fellow freshman Congresswoman Cori Bush (D-MO) over mask usage and social distancing (Greene is anti-mask). This clash led to many online highlighting her then-current social media posts which included a multitude of misinformation, QAnon conspiracies, maskless meetings with her North Georgia constituents, and genuinely bizarre ideas. Ideas including, and I kid you not, the belief that the California wildfires were because of Jewish space lasers.

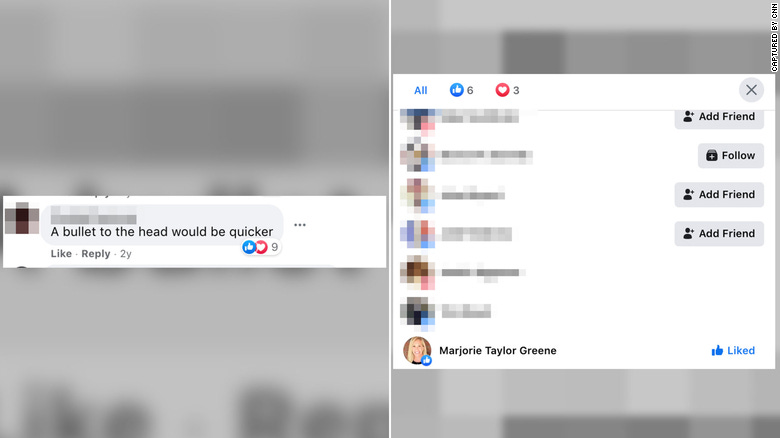

This also included an unearthing of old ‘liked’ Facebook posts and engaging in comments from her own accounts concerning killing members of the FBI and Nancy Pelosi. There are even videos showing her denial of mass shooting victims, which includes footage of Greene attempting to walk down and harass a former Parkland school shooting survivor. Greene has subsequently had her team scrub many of her Twitter and Facebook posts. Despite this, they still live on in the form of screenshots.

Greene represents Georgia’s 14th district in Northwest Georgia and currently will be unopposed in 2022. This poses an interesting quandary for Georgia Republicans as they are currently in charge of redistricting this year. Greene could pose a real problem for state-level Republicans. The Republicans could redistrict Greene if necessary or do the more unlikely move of opening her district up for a more Democrat-based electorate who could likely defeat her. Due to the national trends of Republicans not conceding power, it is unlikely but we will see.

6. The Republicans are moving to act as if nothing happened three weeks ago.

The national Republican Party has decided to move on from impeaching Donald Trump but is still not penalizing some of its more radical members including Marjorie Taylor Green and Lauren Boebert (R-CO). This also includes Mitch McConnell‘s efforts against former president Obama, in addition to his post-inauguration delaying of the transfer of power to now Senate Majority Leader Chuck Schumer.

On top of this McConnell has tried to get the Democrats to sign an agreement from 20 years ago attempting a guarantee effort of bipartisanship. Noticeably this is the same person (McConnell) who in the last year of Barack Obama’s presidential term, not only successfully blocked a Supreme Court nomination, only to rush another nominee a few weeks prior to the 2020 election. McConnell also chose to not converse with bipartisanship in mind with Democrats at all during the four years of the Trump administration. It becomes clearer and clearer now that the Republican Party is not interested in actual bipartisanship or unity. However, the party is very concerned with controlling again all three executive chambers. The Democrats should act accordingly and work on behalf of the 81 million people who voted for their candidate to be the President in November.

7. There was a deadly nitrous leak at a Gainesville, Ga poultry plant

There was a deadly accident at a Gainesville, Georgia chicken plant involving liquid nitrogen that killed six people. This comes as the same plant, owned by Foundation Food Group has been issued previous safety violations over the past few years. This in addition to currently about a half dozen safety violations at the time of the accident. The case is still developing but there are now two officially verified Gofundme accounts for those workers who have been damaged and killed as a result of the accident at the plant.

If you would like to donate you can click on the links below:

The Socially Distanced Book Club sessions are now available for listening!

If you are wanting to catch up on past sessions of The Socially Distanced Book Club, you can now by clicking on any of the links below. They will be available for all members until February 28th, and afterward only for paying members (plus those in the book club) beginning March 1st!

The Color of Law: A Forgotten History of How Our Government Segregated America

Session 1, Session 3, Session 4/White Flight Session1, *Session 2 was not saved by me

White Flight: Atlanta and the making of modern conservatism

Session 2, Session 3, Session 4, Session 5, Session 6, Session 7

Session 1, Session 2, Session 3, Session 4